UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

ANTERO RESOURCES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

|

No fee required. | |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

|

Fee paid previously with preliminary materials. | |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

| Notice of 2018 Annual Meeting of Shareholders |

June 20, 2018

9:00 A.M. Mountain Time,

1615 Wynkoop Street, Denver, CO 80202

To the Shareholders of Antero Resources Corporation:

The 2018 Annual Meeting of Shareholders of Antero Resources Corporation (“Antero”) will be held on Wednesday, June 20, 2018, at 9:00 A.M. Mountain Time, at 1615 Wynkoop Street, Denver, CO 80202. The Annual Meeting is being held for the following purposes:

| 1. | To elect the three Class II members of Antero Resources Corporation’s Board of Directors named in this Proxy Statement to serve until Antero’s 2021 Annual Meeting of Shareholders; | ||

| 2. | To ratify the appointment of KPMG LLP as Antero’s independent registered public accounting firm for the year ending December 31, 2018; | ||

| 3. | To approve, on an advisory basis, the compensation of Antero’s named executive officers; and | ||

| 4. | To transact other such business as may properly come before the meeting and any adjournment or postponement thereof. |

These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting—either in person or by proxy—only if you were a shareholder of record at the close of business on April 23, 2018, the record date for the meeting. The Board requests your proxy for the Annual Meeting, which will authorize the individuals named in the proxy to represent you and vote your shares at the Annual Meeting or any adjournment or postponement thereof.

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy solicitation materials electronically, rather than mailing paper copies of these materials to each shareholder. Beginning on April 30, 2018, we will mail to each shareholder a Notice of Internet Availability of Proxy Materials with instructions on how to access the proxy materials, vote, or request paper copies.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 20, 2018

This Notice of Annual Meeting and Proxy Statement and the Form 10-K are available on our website free of charge at www.anteroresources.com in the “SEC Filings” subsection of the “Investor Relations” section.

| April 25, 2018 | By Order of the Board of Directors |

Glen C. Warren, Jr.

President, Chief Financial Officer and Secretary

YOUR VOTE IS IMPORTANT

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

|

- 2018 Proxy Statement 2 |

|

- 2018 Proxy Statement 3 |

2018 Annual Meeting of Shareholders

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Antero Resources Corporation (“Antero”) for use at the Antero 2018 Annual Meeting of Shareholders (the “Annual Meeting”).

| DATE: | Wednesday, June 20, 2018 |

| TIME: | 9:00 A.M., Mountain Time |

| LOCATION: | 1615 Wynkoop Street, Denver, CO 80202 |

| RECORD DATE: | April 23, 2018 |

How to Vote

If you are a registered shareholder, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| • | Online. You may submit a proxy electronically using the website listed on the Notice of Availability (the “Notice”). Please have the Notice handy when you log on to the website. Internet voting facilities will close and no longer be available after 11:59 p.m., Mountain Time, on Tuesday, June 19, 2018. |

| • | By Telephone. You may submit a proxy by telephone using the toll-free number listed on the Notice. Please have the Notice handy when you call. Telephone voting facilities will close and no longer be available after 11:59 p.m., Mountain Time, on Tuesday, June 19, 2018. |

| • | By Mail. You may request a hard copy proxy card by following the instructions on the Notice. You can submit your proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope. |

| • | In Person. If you are a registered shareholder and you attend the Annual Meeting, you may vote in person by completing a ballot. If you are not present at the Annual Meeting, your shares may be voted only by a person to whom you have given a proper proxy. Attending the meeting without completing a ballot will not count as a vote. |

If you are a beneficial shareholder (meaning your shares are held in “street name” by a broker or bank), you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Most banks and brokers offer Internet and/ or telephone voting. Without your instruction as to how to vote, brokers are not permitted to vote your shares for discretionary matters, which include the election of directors and the advisory vote on compensation of named executive officers.

As of the record date, 317,051,785 shares of common stock were outstanding and entitled to be voted at the Annual Meeting.

|

- 2018 Proxy Statement 4 |

Current Directors and Board Nominees

| Committee Memberships | ||||||||||||

| Name and Age | Director Class and Occupation | Director Since | Independent | AC | CC | NGC | ||||||

| James R. Levy Age: 42 |

Class I Director Partner of Warburg Pincus & Co. and a Managing Director of Warburg Pincus LLC |

2013 |  |

|

||||||||

| Paul M. Rady Age: 64 |

Class I Director Chairman of the Board and Antero Resources Chief Executive Officer |

2004 | ||||||||||

| Glen C. Warren, Jr. Age: 62 |

Class I Director Antero Resources President, Chief Financial Officer, Secretary |

2004 | ||||||||||

| Peter R. Kagan Age: 50 |

Class II Director Nominee, Lead Director Partner of Warburg Pincus & Co. and a Managing Director of Warburg Pincus LLC |

2004 |  |

| ||||||||

| W. Howard Keenan, Jr. Age: 67 |

Class II Director Nominee Member of Yorktown Partners LLC |

2004 |  |

| ||||||||

| Joyce E. McConnell Age: 64 |

Class II Director Nominee Provost and Vice President of Academic Affairs at West Virginia University |

2018 |  |

| ||||||||

| Robert J. Clark Age: 73 |

Class III Director Chairman and Chief Executive Officer of 3 Bear Energy, LLC |

2013 |  |

|

|

| ||||||

| Richard W. Connor Age: 68 |

Class III Director Retired, Former Audit Partner with KPMG LLP |

2013 |  |

|

| |||||||

| Benjamin A. Hardesty Age: 68 |

Class III Director Owner of Alta Energy LLC |

2013 |  |

|

|

| ||||||

|

Chairperson |

Company Performance During 2017

In 2017, Antero:

| • | Achieved 16% debt-adjusted net production growth per share; |

| • | Reduced our finding and development costs by 13% from 2016 and 48% from 2015; |

| • | Monetized over $1 billion of non-exploration and production assets to pay off all outstanding borrowings on the credit facility in the third quarter of 2017; and |

| • | Recorded a 0.03 lost time incident rate (“LTIR”) and 0.57 total recordable incident rate (“TRIR”), representing reductions of 80% and 18%, respectively, from the prior year and the lowest annual LTIR and TRIR on record for Antero. |

|

- 2018 Proxy Statement 5 |

Over the past year, some of our senior leaders have held nine in-person meetings with investors. Based on what we learned in these meetings, we made several substantive changes to our executive compensation program, and we also enhanced our disclosure regarding that program. For more information, see “Compensation Discussion and Analysis—How We Responded to Our Shareholders Following the 2017 Say-on-Pay Vote.”

Corporate Governance Highlights

Our initial group of directors consisted of management and our private equity sponsors. At the time of our initial public offering in 2013, we added three independent directors. We looked for skills in these directors that would help us as a public company, such as technical accounting and auditing, industry experience, and experience in our area of operation. We added our first post-IPO director in 2018 to address specific needs and replace a position once held by one of our sponsor directors. The timeline below shows how our Board has evolved.

| Paul M. Rady Glen C. Warren, Jr. Peter R. Kagan W. Howard Keenan, Jr. |

James R. Levy Richard W. Connor Robert J. Clark Benjamin A. Hardesty |

Joyce E. McConnell | ||

| ||||

| 2004 | 2013 | 2018 | ||

| Antero Resources was formed | Launched the Initial Public Offering | |||

Executive Compensation Highlights

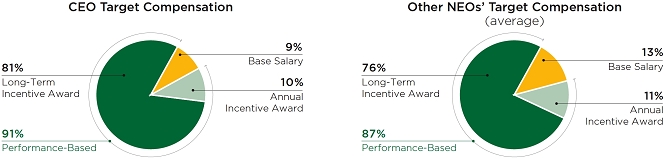

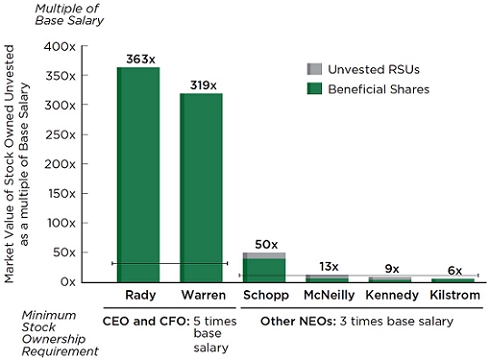

Since our inception, our compensation philosophy has been predominantly focused on recruiting high-impact executives who are motivated to help Antero achieve superior performance and growth with low overhead. Historically, to achieve our objectives, we sought to implement a compensation program that reflected the unique strategy and entrepreneurial culture of our organization by emphasizing long-term equity-based incentive compensation to allow our senior leaders to build significant ownership. As a result, our Named Executive Officers currently hold approximately 9% of our outstanding shares, which ensures they identify with the best interests of our shareholders.

As the company matures, we are transitioning from an entrepreneurial-based management incentive structure to a more traditional compensation program. To that end, we are shifting the emphasis of our incentive-based compensation program from operational performance and absolute growth metrics to performance metrics focused on returns and value creation per share that will reward more disciplined capital investment, efficient operations, and free cash flow generation. In addition, for calendar year 2018, we have adopted a simplified annual incentive program that reduces the number of performance metrics from thirteen to four. Further, we have adjusted our benchmarking practices so that, beginning in 2018, our compensation program will target the market median for all elements of our Named Executive Officers’ compensation. We believe these changes will promote a stronger alignment between Named Executive Officer pay and company performance, and deliver greater value to our shareholders as Antero continues to grow and mature.

Our compensation program, including the recent changes to that program, is discussed in detail in the Compensation Discussion and Analysis section of this Proxy Statement.

|

- 2018 Proxy Statement 6 |

| ITEM ONE: | ELECTION OF DIRECTORS |

Our Board of Directors is divided into three classes. Directors in each class are elected to serve for three-year terms and until either they are re-elected or their successors are elected and qualified, or until their earlier resignation or removal. Each year, the directors of one class stand for re-election as their terms of office expire. Based on recommendations from its Nominating & Governance Committee, the Board has nominated the following individuals for election as Class II directors of Antero with terms to expire at the 2021 Annual Meeting of Shareholders, barring an earlier resignation or removal:

| • | Peter R. Kagan |

| • | W. Howard Keenan, Jr. |

| • | Joyce E. McConnell |

All three nominees currently serve as Class II directors of Antero. Their biographical information is contained in “Directors” below.

The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the size of the Board will be reduced or the individuals acting under your proxy will vote for the election of a substitute nominee recommended by the Board.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

|

- 2018 Proxy Statement 7 |

We were originally formed in 2004 as Antero Resources II Corporation. Through a series of internal reorganization transactions, Antero Resources II Corporation’s successor and certain of its affiliates were merged with and into Antero Resources Appalachian Corporation. That entity was renamed Antero Resources Corporation in June 2013 in connection with our initial public offering.

Set forth below is the background, business experience, attributes, qualifications and skills of Antero’s directors and director nominees. In some cases, references to our directors’ tenure with Antero date back to our original founding in 2004.

|

James R. Levy

Age: 42 Director Since: 2013 Committee Memberships: Compensation Committee |

Key Skills, Attributes and Qualifications:

| • | Director since Antero’s initial public offering in October 2013 |

| • | Joined Warburg Pincus in 2006 and is currently a Partner of Warburg Pincus & Co. and a Managing Director of Warburg Pincus LLC, focusing on investments in the energy industry |

| • | Worked as a private equity investor at Kohlberg & Company for three years and in M&A advisory at Wasserstein Perella & Co. for three years |

| • | Serves on the Board of Directors of AMGP GP LLC, the general partner of Antero Midstream GP LP |

| • | Serves on the boards of directors of several private companies in the oil and gas industry |

| • | Serves as a trustee of Prep for Prep, a leadership development program |

Has significant experience with energy companies and investments and broad knowledge of the oil and gas industry.

Other Public Company Boards:

| • | Laredo Petroleum, Antero Midstream GP LP |

|

- 2018 Proxy Statement 8 |

|

Paul M. Rady

Age: 64 Director Since: 2004 Chief Executive Officer

and Chairman |

Key Skills, Attributes and Qualifications:

| • | Chief Executive Officer and Chairman since May 2004 |

| • | Served as Chief Executive Officer and Chairman of Antero’s predecessor, Antero Resources Corporation, from its founding in 2002 until its sale to XTO Energy, Inc. in 2005 |

| • | Chairman of the Board of Directors of Antero Midstream Partners GP LLC, the general partner of Antero Midstream Partners LP |

| • | Chairman of the Board of Directors of AMGP GP LLC, the general partner of Antero Midstream GP LP |

| • | Served as President, CEO and Chairman of Pennaco Energy from 1998 until its sale to Marathon in 2001 |

| • | Worked with Barrett Resources from 1990 until 1998, moving from Chief Geologist to Exploration Manager, EVP Exploration; President, COO and Director; and ultimately CEO |

| • | Began his career with Amoco, where he served ten years as a geologist focused on the Rockies and Mid-Continent |

Has significant experience as a chief executive of oil and gas companies, together with his training as a geologist and broad industry knowledge.

Other Public Company Boards:

| • | Antero Midstream Partners LP, Antero Midstream GP LP |

|

Glen C. Warren, Jr.

Age: 62 Director Since: 2004 President, Chief Financial

Officer and Secretary |

Key Skills, Attributes and Qualifications:

| • | President, Chief Financial Officer and Secretary since May 2004 |

| • | Served as President, Chief Financial Officer and Secretary and as a director of Antero’s predecessor, Antero Resources Corporation, from its founding in 2002 until its sale to XTO Energy, Inc. in 2005 |

| • | Serves on the Board of Directors of Antero Midstream Partners GP LLC, the general partner of Antero Midstream Partners LP |

| • | Serves on the Board of Directors of AMGP GP LLC, the general partner of Antero Midstream GP LP |

| • | Served as EVP, CFO and Director of Pennaco Energy from 1998 until its sale to Marathon in 2001 |

| • | Spent ten years as a natural resources investment banker focused on equity and debt financing and M&A advisory with Lehman Brothers, Dillon Read & Co. Inc. and Kidder, Peabody & Co. |

| • | Began his career as a landman in the Gulf Coast region with Amoco, where he spent six years |

Has significant experience as a chief financial officer of oil and gas companies, together with his experience as an investment banker and broad industry knowledge.

Other Public Company Boards:

| • | Antero Midstream Partners LP, Antero Midstream GP LP |

|

- 2018 Proxy Statement 9 |

Class II Directors Seeking Reelection

|

Peter R. Kagan

Age: 50 Director Since: 2004 Committee Memberships: Nominating & Governance Committee |

Key Skills, Attributes and Qualifications:

| • | Joined Warburg Pincus in 1997 and is currently a Partner of Warburg Pincus & Co., a Managing Director of Warburg Pincus LLC, and a member of Warburg Pincus LLC’s Executive Management Group; leads the firm’s investment activities in energy and natural resources |

| • | Worked in investment banking at Salomon Brothers in both New York and Hong Kong |

| • | Serves on the boards of directors of several private companies in the oil and gas industry |

| • | Serves on the Board of Directors of Antero Midstream Partners GP LLC, the general partner of Antero Midstream Partners LP |

| • | Serves on the Board of Directors of AMGP GP LLC, the general partner of Antero Midstream GP LP |

| • | Director of Resources for the Future, a non-profit research institution, and a trustee of Milton Academy |

Has significant experience with energy companies and investments and broad knowledge of the oil and gas industry.

Other Public Company Boards:

| • | Laredo Petroleum, Antero Midstream Partners LP, Antero Midstream GP LP |

|

W. Howard Keenan, Jr.

Age: 67 Director Since: 2004 Committee Memberships: Nominating & Governance Committee

|

Key Skills, Attributes and Qualifications:

| • | Since 1997, has been a Member of Yorktown Partners LLC, a private investment manager focused on the energy industry |

| • | From 1975 to 1997, was in the Corporate Finance Department of Dillon, Read & Co. Inc. and active in the private equity and energy areas, including the founding of the first Yorktown Partners fund in 1991 |

| • | Serves on the boards of directors of multiple Yorktown Partners portfolio companies |

| • | Serves on the Board of Directors of Antero Midstream Partners GP LLC, the general partner of Antero Midstream Partners LP |

| • | Serves on the Board of Directors of AMGP GP LLC, the general partner of Antero Midstream GP LP |

Has over forty years of experience with energy companies and investments and broad knowledge of the oil and gas industry.

Other Public Company Boards:

| • | Solaris Oilfield Infrastructure, Inc., Ramaco Resources, Inc., Antero Midstream Partners LP, Antero Midstream GP LP, Concho Resources (until 2013), Geomet Inc. (until 2012) |

|

- 2018 Proxy Statement 10 |

|

Joyce E. McConnell

Age: 64 Director Since: 2018 Committee Memberships: Nominating & Governance Committee |

Key Skills, Attributes and Qualifications:

| • | Provost and Vice President of Academic Affairs at West Virginia University since 2014, where she is responsible for the administration of all academic policies, programs, facilities and budgetary matters |

| • | From 2008 to 2014, served as Dean of the West Virginia University College of Law, where she helped raise $36 million in capital campaign funds, expand multidisciplinary opportunities, and develop experiential and clinical programs and facilities |

| • | As Dean, helped implement energy research initiatives, including the Energy and Sustainable Development and Land Use Sustainability Clinic at the College of Law, West Virginia University’s Energy Institute, and the energy finance emphasis in West Virginia University’s College of Business & Economics |

| • | Currently serves on the National Collegiate Athletic Association Division One Committee on Infractions and as Chair of the Board of Trustees of the Nature Conservancy in West Virginia |

| • | From 2016 to 2017, served as President of the West Virginia Bar Association |

Has broad legal and management experience and deep local ties to the West Virginia community in which Antero operates.

|

Robert J. Clark

Age: 73 Director Since: 2013 Committee Memberships: Compensation Committee (chair), Audit Committee, and Nominating & Governance Committee

|

Key Skills, Attributes and Qualifications:

| • | Chairman and Chief Executive Officer of 3 Bear Energy, LLC, a midstream energy company with operations in the Rocky Mountains, since its formation in March 2013 |

| • | Formed, operated and subsequently sold Bear Tracker Energy in 2013 (to Summit Midstream Partners, LP); a portion of Bear Cub Energy in 2007 (to Regency Energy Partners, L.P.), and the remaining portion in 2008 (to GeoPetro Resources Company); and Bear Paw Energy in 2001 (to ONEOK Partners, L.P., formerly Northern Border Partners, L.P.) |

| • | Member of the Board of Trustees of Bradley University, the Children’s Hospital Colorado Foundation, and Judi’s House, a Denver charity for grieving children and families |

Has significant experience with energy companies, with over 45 years of experience in the industry.

|

- 2018 Proxy Statement 11 |

|

Richard W. Connor

Age: 68 Director Since: 2013 Committee Memberships: Audit Committee (chair), and Nominating & Governance Committee |

Key Skills, Attributes and Qualifications:

| • | Audit partner with KPMG LLP from 1980 until retirement in September 2009, principally serving publicly traded clients in the energy, mining, telecommunications, and media industries |

| • | Appointed to KPMG’s SEC Reviewing Partners Committee in 1987, where he served until his retirement |

| • | Served from 1996 to 2008 as Managing Partner of KPMG’s Denver office |

| • | Serves on the Board of Directors and as chairman of the audit committee of Antero Midstream Partners GP LLC, the general partner of Antero Midstream Partners LP |

Has experience in technical accounting and auditing matters, knowledge of SEC filing requirements, and experience with a variety of energy clients.

Other Public Company Boards:

| • | Zayo Group Holdings, Inc. and Zayo Group LLC, Centerra Gold, Inc., Antero Midstream Partners LP |

|

Benjamin A Hardesty

Age: 68 Director Since: 2013 Committee Memberships: Nominating & Governance Committee (chair), Audit Committee, and Compensation Committee |

Key Skills, Attributes and Qualifications:

| • | Has been the owner of Alta Energy LLC, a consulting business focused on oil and natural gas in the Appalachian Basin and onshore United States, since May 2010 |

| • | President of Dominion E&P, Inc., a subsidiary of Dominion Resources Inc. engaged in the exploration and production of natural gas in North America, from September 2007 until retirement in May 2010. Joined Dominion in 1995 and served as president of Dominion Appalachian Development, Inc. until 2000 and general manager and vice president—Northeast Gas Basins until 2007 |

| • | Member of the Board of Directors of Blue Dot Energy Services, LLC from 2011 until its sale to B/E Aerospace, Inc. in 2013 |

| • | From 1982 to 1995, served successively as vice president, executive vice president and president of Stonewall Gas Company, and from 1978 to 1982, served as vice president-operations of Development Drilling Corp. |

| • | Served as an active duty officer in the U.S. Army Security Agency for two years and as a reserve officer |

| • | Director and past president of the West Virginia Oil & Natural Gas Association and past president of the Independent Oil & Gas Association of West Virginia |

| • | Trustee and past chairman of the Nature Conservancy of West Virginia and a member of the Board of Directors of the West Virginia Chamber of Commerce |

| • | Serves as a member of the Visiting Committee of the Petroleum Natural Gas Engineering Department of the Statler College of Engineering and Mineral Resources at West Virginia University |

Has significant experience in the oil and natural gas industry, including in Antero’s areas of operation.

Other Public Company Boards:

| • | KLX Inc. |

|

- 2018 Proxy Statement 12 |

Recent Corporate Governance Developments

On February 20, 2018, the Board, upon the recommendation of the Nominating & Governance Committee, appointed Joyce E. McConnell to the Board as a Class II director and simultaneously appointed Ms. McConnell to the Nominating & Governance Committee. Ms. McConnell, a nationally recognized scholar and West Virginia leader, has been the Provost and Vice President of Academic Affairs at West Virginia University since 2014 and has spearheaded several energy-related initiatives since joining WVU’s administration in 2008. As discussed in further detail below, we are committed to appointing qualified nominees to serve on the Board. The Nominating & Governance Committee considers diversity, as well as other factors, in identifying candidates for the Board’s consideration. The Board is pleased that the addition of Ms. McConnell will further broaden the Board’s talent, experience and diversity.

As discussed in further detail below, over the past year, Antero engaged in extensive shareholder outreach. As part of the efforts undertaken to address our shareholders’ input, we significantly enhanced our proxy statement disclosure this year.

Corporate Governance Guidelines

The Board believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duty to shareholders. Antero’s Corporate Governance Guidelines include provisions concerning the following:

| • | size of the Board; |

| • | qualifications, independence, responsibilities, tenure and compensation of directors; |

| • | service on other boards; |

| • | director resignation process; |

| • | role of Chairman of the Board; |

| • | meetings of the Board and meetings of independent directors; |

| • | interaction of the Board with external constituencies; |

| • | performance review of the Board and director orientation and continuing education; |

| • | attendance at meetings of the Board and the Annual Meeting; |

| • | shareholder communications with directors; |

| • | committee functions, committee charters and independence of committee members; |

| • | director access to independent advisors and management; and |

| • | management evaluation and succession planning. |

The Corporate Governance Guidelines are available on Antero’s website at www.anteroresources.com in the “Corporate Governance” subsection of the “Investor Relations” section. The Nominating & Governance Committee reviews the Corporate Governance Guidelines periodically and as necessary, and any proposed additions to or amendments of the Corporate Governance Guidelines are presented to the Board for its approval.

Rather than adopting categorical standards, the Board assesses director independence on a case-by-case basis, in each case consistent with applicable legal requirements and the listing standards of the New York Stock Exchange (NYSE). After reviewing all relationships each director has with Antero, including the nature and extent of any business relationships between Antero and each director, as well as any significant charitable contributions Antero makes to organizations where its directors

|

- 2018 Proxy Statement 13 |

serve as board members or executive officers, the Board has affirmatively determined that the following directors have no material relationships with Antero and are independent as defined by NYSE listing standards: Messrs. Levy, Kagan, Keenan, Connor, Clark and Hardesty and Ms. McConnell. Neither Mr. Rady, the CEO, nor Mr. Warren, the President and CFO, is considered by the Board to be an independent director.

The Board does not have a formal policy addressing whether the roles of Chairman and Chief Executive Officer should be separate or combined. The directors serving on the Board possess considerable professional and industry experience, significant experience as directors of both public and private companies, and a unique knowledge of the challenges and opportunities Antero faces. Accordingly, the Board believes it is in the best position to evaluate Antero’s needs and to determine how best to organize Antero’s leadership structure to meet those needs.

At present, the Board has chosen to combine the positions of Chairman and Chief Executive Officer. While the Board believes it is important to retain the flexibility to determine whether the roles of Chairman and Chief Executive Officer should be separated or combined, the Board believes the current Chief Executive Officer is the individual with the necessary experience, commitment, and support of the other members of the Board to effectively carry out the role of Chairman.

The Board believes that combining the roles of Chairman and CEO at the present time promotes better alignment of strategic development and execution, more effective implementation of strategic initiatives, and clearer accountability for Antero’s success or failure. Moreover, the Board believes this leadership structure does not impede independent oversight of Antero; seven of the nine members of the Board are independent under NYSE rules. The Nominating & Governance Committee reviews this leadership structure every year.

Executive Sessions; Election of Lead Director

To facilitate candid discussion among Antero’s directors, the non-management directors meet in regularly scheduled executive sessions.

Pursuant to the Corporate Governance Guidelines, the Board, based on the recommendation of the Nominating & Governance Committee, is permitted to choose a Lead Director to preside at executive sessions of independent directors. The Board elected Mr. Kagan, an independent director, to serve as the Lead Director. In this capacity, Mr. Kagan provides, in conjunction with the Chairman, leadership and guidance to the Board. As the Lead Director, Mr. Kagan also serves as chairman of executive sessions of the non-management directors and establishes the agenda for the meetings of the independent directors in executive sessions.

How Director Nominees are Selected

Renominating Incumbent Directors

Before recommending to the Board that an existing director be nominated for reelection at the annual meeting of shareholders, the Nominating & Governance Committee will review and consider the director’s:

| • | past Board and committee meeting attendance and performance; |

| • | length of Board service; |

| • | personal and professional integrity, including commitment to Antero’s core values; |

| • | relevant experience, skills, qualifications and contributions to the Board; and |

| • | independence under applicable standards. |

|

- 2018 Proxy Statement 14 |

Appointing New Directors and Filling Vacancies

The Board created a detailed matrix to formalize the process of selecting new directors. The matrix pinpoints:

| • | areas where the current Board was strong, |

| • | areas where the current Board could be enhanced, and |

| • | qualities that all of Antero’s directors should have. |

For example, the Board believes that all directors should have sound business judgment, personal and professional integrity, an ability to work as part of a team, willingness to commit the required time to serve as a Board member, business experience, and financial literacy.

As the Board completed and discussed this matrix in 2017, our directors agreed that, as a group, they are particularly strong in the area of industry knowledge. Accordingly, they agreed that Antero’s next director should have a different type of background—preferably in at least one of several specialized professional skills, including law. The Board also was cognizant that several shareholders have expressed a preference for more personal diversity among our directors. Although the Board does not have a formal policy on diversity, the Nominating & Governance Committee considers diversity along with other factors in reviewing director candidates.

With those specific goals in mind, the Nominating & Governance Committee sought recommendations for director candidates from the current directors and from management, and ultimately recommended Joyce McConnell, a distinguished legal scholar with an extensive background in academic administration. Ms. McConnell met personally with each member of our Board, and completed a comprehensive questionnaire regarding her financial and business affiliations. After thorough discussion, the Board unanimously voted to invite her to become a director.

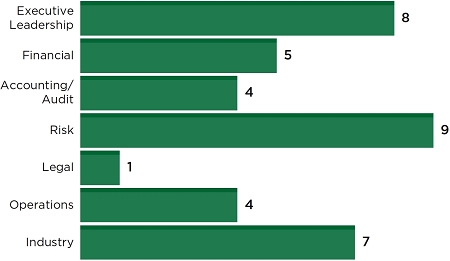

With the addition of Ms. McConnell, our Board embodies a diverse set of experiences, qualifications, attributes, and skills, as shown below:

The Nominating & Governance Committee will treat recommendations for directors that are received from Antero’s shareholders in the same manner as recommendations received from any other source.

Majority Vote Director Resignation Policy

Directors are elected by a plurality of votes cast in an uncontested election. The Corporate Governance Guidelines require that an incumbent director who fails to receive the required number of votes for reelection must tender a resignation. The Nominating & Governance Committee will act on an expedited basis to determine whether to accept any such resignation, and will submit its recommendation for prompt consideration by the Board. The Board expects the director whose resignation is under consideration to abstain from participating in this decision. The Nominating & Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation.

|

- 2018 Proxy Statement 15 |

Board’s Role in Risk Oversight

In the normal course of its business, Antero is exposed to a variety of risks, including market risks relating to changes in commodity prices, interest rate risks, technical risks affecting Antero’s resource base, political risks, and credit and investment risk. The Board and each of its committees has distinct responsibilities for monitoring those risks, as shown below.

| The Board of Directors | ||

| The Board oversees Antero’s strategic direction, and in doing so considers the potential rewards and risks of Antero’s business opportunities and challenges, and monitors the development and management of risks that impact our strategic goals. | ||

Audit Committee

The Audit Committee assists the Board in fulfilling its oversight responsibilities by monitoring the effectiveness of Antero’s systems of financial reporting, auditing, internal controls and legal and regulatory compliance.

|

Nominating & Governance Committee

The Nominating & Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for our directors and executive officers, and corporate governance.

|

Compensation Committee

The Compensation Committee assists the Board in fulfilling its oversight responsibilities by overseeing Antero’s compensation policies and practices.

|

Board and Committee Self-Evaluations

The Board believes that a robust and constructive evaluation process is an essential component of Board effectiveness and good corporate governance. To that end, the Board and each of the three standing committees conducts an annual self-assessment to evaluate their performance, composition, and effectiveness, and to identify areas for improvement.

These evaluations take the form of wide-ranging and candid discussions. The Lead Director facilitates discussions evaluating the full Board, and the committee chairs facilitate discussions regarding their respective committees. The Board and committee evaluations occasionally lead to changes in practices or procedures.

Pursuant to Antero’s Corporate Governance Guidelines, directors are encouraged to attend the Annual Meetings of Shareholders. All of the then-serving members of our Board attended the 2017 Annual Meeting.

Interested Party Communications

General communications

Shareholders and other interested parties may communicate by writing to Antero Resources Corporation, 1615 Wynkoop Street, Denver, Colorado 80202. Shareholders may submit their communications to the Board, any committee of the Board, or individual directors on a confidential or anonymous basis by sending the communication in a sealed envelope marked “Shareholder Communication with Directors” and clearly identifying the intended recipient(s) of the communication.

|

- 2018 Proxy Statement 16 |

Antero’s Chief Administrative Officer will review and forward each communication, as expeditiously as reasonably practicable, to the addressee(s) if: (1) the communication complies with the requirements of any applicable policy adopted by the Board relating to the subject matter of the communication; and (2) the communication falls within the scope of matters generally considered by the Board. To the extent the subject matter of a communication is appropriate and relates to matters that have been delegated by the Board to a committee or to an executive officer of Antero, the Chief Administrative Officer may forward the communication to the executive officer or the chair of the committee to which the matter has been delegated.

Legal or compliance concerns

Information may be submitted confidentially and anonymously, although Antero may be obligated by law to disclose the information or identity of the person providing the information in connection with government or private legal actions and in other circumstances. Antero’s policy is not to take any adverse action, and not to tolerate any retaliation, against any person for asking questions or making good faith reports of possible violations of law, Antero’s policies or its Corporate Code of Business Conduct and Ethics.

Available Governance Materials

The following materials are available on Antero’s website at www.anteroresources.com under “Investor Relations” and then “Corporate Governance.”

| • | Charter of the Audit Committee of the Board; |

| • | Charter of the Compensation Committee of the Board; |

| • | Charter of the Nominating & Governance Committee of the Board; |

| • | Corporate Code of Business Conduct and Ethics; |

| • | Financial Code of Ethics; and |

| • | Corporate Governance Guidelines. |

Shareholders may obtain a copy, free of charge, of each of these documents by sending a written request to Antero Resources Corporation, 1615 Wynkoop Street, Denver, Colorado, 80202.

|

- 2018 Proxy Statement 17 |

MEETINGS AND COMMITTEES OF DIRECTORS

The Board held eight meetings in 2017. The six then-serving outside directors (Messrs. Levy, Kagan, Keenan, Connor, Clark and Hardesty) held six executive sessions. No director attended fewer than 75% of the meetings of the Board and of the committees of the Board on which that director served.

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating & Governance Committee. The charters of all three committees are available on Antero’s website at www.anteroresources.com in the “Corporate Governance” subsection of the “Investor Relations” section. The Board creates ad hoc committees on an as-needed basis. In 2017, Robert J. Clark and Benjamin A. Hardesty served on an ad hoc Special Committee formed by the Board to review certain potential related party transactions.

Members: Richard W. Connor (chair), Robert J. Clark, Benjamin A. Hardesty

Number of meetings in 2017: 5

The Audit Committee oversees, reviews, acts on and reports on various auditing and accounting matters to the Board, including:

| • | the selection of Antero’s independent accountants, |

| • | the scope of annual audits, |

| • | fees to be paid to the independent accountants, |

| • | the performance of Antero’s independent accountants, and |

| • | Antero’s accounting practices. |

In addition, the Audit Committee oversees Antero’s compliance programs relating to legal and regulatory requirements.

Rules implemented by the NYSE and the SEC require Antero to have an audit committee composed of at least three directors who meet particular independence and experience standards (including the heightened requirements applicable to audit committee members). All members of the Audit Committee meet the NYSE’s independence standards, including the heightened requirements under SEC rules applicable to audit committee members. In addition, the Board believes that Mr. Connor possesses substantial financial experience based on his extensive background in technical accounting and auditing matters as a former audit partner of KPMG LLP. As a result of these qualifications, Antero believes Mr. Connor is an “audit committee financial expert” as defined in SEC rules.

Members: Robert J. Clark (chair), Benjamin A. Hardesty, James R. Levy

Number of meetings in 2017: 6

The Compensation Committee establishes salaries, incentives and other forms of compensation for our executive officers. The Compensation Committee also administers Antero’s incentive compensation and benefit plans.

Rules implemented by the NYSE require Antero to have a compensation committee composed of members who satisfy NYSE independence standards. All members of the Compensation Committee meet the NYSE’s independence standards, including the heightened requirements applicable to compensation committee members, and also meet the heightened independence requirements under SEC rules and the tax code. No Antero executive officer serves on the board of directors of a company that has an executive officer that serves on our Board.

|

- 2018 Proxy Statement 18 |

Nominating & Governance Committee

Members: Benjamin A. Hardesty (chair), Peter R. Kagan, Richard W. Connor, W. Howard Keenan, Jr., Robert J. Clark, Joyce E. McConnell (as of February 2018)

Number of meetings in 2017: 4

The Nominating & Governance Committee identifies, evaluates and recommends qualified nominees to serve on the Board, develops and oversees Antero’s internal corporate governance processes, and directs all matters relating to the succession of Antero’s CEO.

Rules implemented by the NYSE require Antero to have a nominating & governance committee composed entirely of independent directors. All members of the Nominating & Governance committee meet the NYSE’s independence standards.

Our non-employee directors are entitled to receive compensation consisting of retainers, fees and equity awards as described below. The Compensation Committee reviews and approves non-employee director compensation on a periodic basis.

Our employee directors, Messrs. Rady and Warren, do not receive additional compensation for their services as directors. All compensation that Messrs. Rady and Warren received from Antero as employees is disclosed in the Summary Compensation Table.

Messrs. Kagan and Levy have agreed or are otherwise obligated to transfer all or a portion of the compensation they receive for their service as directors to the shareholders with which they are affiliated.

Each non-employee director received the following compensation for the 2017 fiscal year:

| • | an annual retainer of $70,000; |

| • | an additional $5,000 annual retainer for the lead director; |

| • | an additional retainer of $7,500 for each member of the Audit Committee, plus an additional $12,500 for the chairperson; |

| • | an additional retainer of $5,000 for each member of the Compensation Committee, plus an additional $10,000 for the chairperson; |

| • | an additional retainer of $5,000 for each member of the Nominating & Governance Committee, plus an additional $5,000 for the chairperson; and |

| • | an additional retainer of $10,000 for each member of the Special Committee (an ad hoc Board committee), plus an additional $5,000 for the chairperson. |

All retainers are paid in cash on a quarterly basis in arrears, but directors have the option to elect, on an annual basis, to receive all or a portion of their retainers in the form of shares of our common stock. Directors do not receive any meeting fees, but each director is reimbursed for (1) travel and miscellaneous expenses to attend meetings and activities of the Board or its committees, and (2) travel and miscellaneous expenses related to the director’s participation in general education and orientation programs for directors.

|

- 2018 Proxy Statement 19 |

Equity-Based Compensation and Stock Ownership Guidelines

In addition to cash compensation, our non-employee directors receive annual equity-based compensation consisting of fully vested stock with an aggregate grant date value equal to $200,000, subject to the terms and conditions of the AR LTIP and the award agreements pursuant to which such awards are granted. Under our stock ownership guidelines adopted in 2013, by the later of October 7, 2018, or five years after being appointed to the Board, our non-employee directors other than Messrs. Kagan, Keenan and Levy are required to hold shares of our common stock with a fair market value equal to at least five times the amount of their annual cash retainer.

Total Non-Employee Director Compensation

The following table provides information concerning the compensation of our non-employee directors for the fiscal year ended December 31, 2017.

| Fees Earned | ||||||

| or Paid in Cash | Stock Awards | Total | ||||

| Name | ($)(1) | ($)(2) | ($) | |||

| Peter R. Kagan(3) | 80,000 | 200,000 | 280,000 | |||

| W. Howard Keenan, Jr. | 75,000 | 200,000 | 275,000 | |||

| Richard W. Connor | 95,000 | 200,000 | 295,000 | |||

| Robert J. Clark(3) | 112,500 | 200,000 | 312,500 | |||

| Benjamin A. Hardesty | 102,500 | 200,000 | 302,500 | |||

| James R. Levy(3) | 75,000 | 200,000 | 275,000 |

| (1) | Includes annual cash retainer, committee fees and committee chair fees for each non-employee director during fiscal 2017, as more fully explained above. |

| (2) | Effective December 15, 2015, Antero adopted a non-employee director compensation policy that calls for quarterly grants of fully vested stock. Amounts in this column reflect the aggregate grant date fair value of stock granted under the AR LTIP in fiscal year 2017, computed in accordance with FASB ASC Topic 718. See Note 9 to our consolidated financial statements on Form 10-K for the year ended December 31, 2017, for additional detail regarding assumptions underlying the value of these equity awards. The grant date fair value for stock awards is based on the closing price of our common stock on the grant date. |

| (3) | Messrs. Kagan, Levy and Clark elected to receive all of their retainer fees for the 2017 fiscal year in the form of common stock. |

Effective December 19, 2017, Antero adopted a non-employee director compensation policy that formalizes the compensation arrangements described above.

|

- 2018 Proxy Statement 20 |

| ITEM TWO: | RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee of the Board has selected KPMG LLP as Antero’s independent registered public accounting firm for the year ending December 31, 2018. KPMG LLP has audited Antero’s and its predecessor’s financial statements since 2003. The Audit Committee annually evaluates the accounting firm’s qualifications to continue to serve Antero. In evaluating the accounting firm, the Audit Committee considers the reputation of the firm and the local office, the industry experience of the engagement partner and the engagement team, and the experience of the engagement team with clients of similar size, scope and complexity as Antero. The Audit Committee is directly involved in the selection of the new engagement partner when rotation is required every five years in accordance with SEC rules. KPMG LLP completed the audit of Antero’s annual consolidated financial statements for the year ended December 31, 2017, on February 13, 2018.

The Board is submitting the selection of KPMG LLP for ratification at the Annual Meeting. The submission of this matter for ratification by shareholders is not legally required, but the Board and the Audit Committee believe the ratification proposal provides an opportunity for shareholders to communicate their views about an important aspect of corporate governance. If our shareholders do not ratify the selection of KPMG LLP, the Audit Committee will reconsider, but will not be required to rescind, the selection of that firm as Antero’s independent registered public accounting firm.

Representatives of KPMG LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement, and are expected to be available to respond to appropriate questions.

The Audit Committee has the authority and responsibility to retain, evaluate and replace Antero’s independent registered public accounting firm. Shareholder ratification of the appointment of KPMG LLP does not limit the authority of the Audit Committee to change Antero’s independent registered public accounting firm at any time.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE RATIFICATION OF THE SELECTION OF KPMG LLP AS ANTERO’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2018.

|

- 2018 Proxy Statement 21 |

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

Pursuant to its charter, the Audit Committee’s principal functions include the duty to: (i) oversee the appointment, compensation, retention and oversight of the work of the independent auditors hired for the purpose of issuing an audit report or performing other audit, review or attest services for Antero; (ii) pre-approve audit or non-audit services proposed to be rendered by Antero’s independent registered public accounting firm; (iii) annually review the qualifications and independence of the independent registered public accounting firm’s engagement partner and other senior personnel who are providing services to Antero; (iv) review with management and the independent registered public accounting firm Antero’s annual and quarterly financial statements, earnings press releases, and financial information and earnings guidance provided to analysts and ratings agencies; (v) oversee Antero’s internal audit function; (vi) ratify related party transactions as set forth in Antero’s Related Persons Transactions Policy; (vii) review with management Antero’s major financial risk exposures; (viii) assist the Board in monitoring compliance with legal and regulatory requirements; (ix) prepare the report of the Audit Committee for inclusion in Antero’s proxy statement; and (x) annually review and reassess its performance and the adequacy of its charter.

While the Audit Committee has the responsibilities and powers set forth in its charter, and Antero’s management and the independent registered public accounting firm are accountable to the Audit Committee, it is not the duty of the Audit Committee to plan or conduct audits or to determine that Antero’s financial statements and disclosures are complete and accurate and in accordance with generally accepted accounting principles and applicable laws, rules and regulations.

In performing its oversight role, the Audit Committee has reviewed and discussed Antero’s audited financial statements with management and the independent registered public accounting firm. The Audit Committee also has discussed with the independent registered public accounting firm the matters required to be discussed by the Public Company Accounting Oversight Board Auditing Standard No. 16, Communications with Audit Committees. The Audit Committee has received the written disclosures and the written statement from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence. The Audit Committee also has considered whether the provision of non-audit services by the independent registered public accounting firm to Antero is compatible with maintaining the firm’s independence, and has discussed with the independent registered public accounting firm its independence.

Based on the reviews and discussions described in this Audit Committee Report, and subject to the limitations on the roles and responsibilities of the Audit Committee referred to herein and in its charter, the Audit Committee recommended to the Board that Antero’s audited financial statements for the year ended December 31, 2017, be included in the Form 10-K, which was filed with the SEC on February 13, 2018. As recommended by the NYSE’s corporate governance rules, the Audit Committee also considered whether, to ensure continuing auditor independence, it would be advisable to regularly rotate Antero’s independent registered public accounting firm. The Audit Committee has concluded that the current benefits to Antero from continued retention of KPMG LLP warrant retaining the accounting firm as Antero’s independent registered public accounting firm for the year ending December 31, 2018. The Audit Committee will continue to review this issue on an annual basis.

Members of the Audit Committee:

Richard W. Connor (Chairman)

Robert J. Clark

Benjamin A. Hardesty

|

- 2018 Proxy Statement 22 |

The table below sets forth the aggregate fees and expenses billed by KPMG LLP for the last two fiscal years to Antero (in thousands):

| For the Years Ended | ||||||||

| December 31 | ||||||||

| 2016 | 2017 | |||||||

| Audit Fees(1) | ||||||||

| Audit and Quarterly Reviews | $ | 1,807 | $ | 1,880 | ||||

| Other Filings | 715 | 452 | ||||||

| SUBTOTAL | 2,522 | 2,332 | ||||||

| Audit-Related Fees | – | – | ||||||

| Tax Fees | – | – | ||||||

| TOTAL | $ | 2,522 | $ | 2,332 | ||||

| (1) | Includes (a) the audit of Antero’s annual consolidated financial statements included in the Annual Report on Form 10-K and internal controls over financial reporting, review of Antero’s quarterly financial statements included in Quarterly Reports on Form 10-Q, and review of Antero’s other filings with the SEC, including comfort letters and consents, and (b) the audit of the financial statements of Antero Midstream Partners LP. |

The charter of the Audit Committee and its pre-approval policy require that the Audit Committee review and pre-approve the independent registered public accounting firm’s fees for audit, audit-related, tax and other services. The Chairman of the Audit Committee has the authority to grant pre-approvals up to a certain limit, provided such approvals are within the pre-approval policy and are ratified by the Audit Committee at a subsequent meeting. For the year ended December 31, 2017, the Audit Committee approved 100% of the services described above.

|

- 2018 Proxy Statement 23 |

| ITEM THREE: | ADVISORY VOTE ON EXECUTIVE COMPENSATION |

Our policies are conceived with the intention of attracting and retaining highly qualified individuals capable of contributing to the creation of value for our shareholders. Our programs are designed to be competitive with market practices and align the interests of our Named Executive Officers with those of Antero and its shareholders.

Shareholders are urged to read the Compensation Discussion and Analysis section of this Proxy Statement, which discusses how our compensation design and practices reflect our compensation philosophy. The Compensation Committee and the Board believe that our compensation practices are effective in implementing our guiding principles.

Pursuant to Section 14A of the Securities Exchange Act of 1934, we are submitting a proposal to our shareholders for an advisory vote to approve the compensation of our Named Executive Officers. This proposal, commonly known as a “say-on-pay” proposal, gives shareholders the opportunity to express their views on the compensation of our Named Executive Officers. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the principles, policies and practices described in this Proxy Statement. Accordingly, the following resolution is submitted for shareholder vote at the Annual Meeting:

“RESOLVED, that the shareholders of Antero Resources Corporation approve, on an advisory basis, the compensation of its named executive officers as disclosed in the proxy statement for the 2018 Annual Meeting pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and other related tables and disclosures.”

As this is an advisory vote, the result is not likely to affect previously granted compensation. The Compensation Committee will consider the outcome of the vote when evaluating our compensation practices going forward.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT.

|

- 2018 Proxy Statement 24 |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides details on the following matters:

| • | Our shareholder engagement efforts following our 2017 say-on-pay vote |

| • | Our 2017 company performance |

| • | Our 2017 executive compensation program and the compensation awarded under that program |

| • | Changes to our compensation program made in 2018 |

2017 NAMED EXECUTIVE OFFICERS

| Name | Principal Position |

| Paul M. Rady | Chairman of the Board and Chief Executive Officer |

| Glen C. Warren, Jr. | Director, President, Chief Financial Officer and Secretary |

| Alvyn A. Schopp | Chief Administrative Officer, Regional Senior Vice President and Treasurer |

| Kevin J. Kilstrom | Senior Vice President—Production |

| Ward D. McNeilly | Senior Vice President—Reserves, Planning and Midstream |

| Michael N. Kennedy | Senior Vice President—Finance and Antero Midstream Partners LP Chief Financial Officer |

How We Responded to Our Shareholders Following the 2017 Say-on-Pay Vote

Antero’s annual advisory vote on the compensation of our Named Executive Officers (commonly known as “say-on-pay”) received 67% support at the 2017 Annual Meeting of Shareholders. Although the compensation of our Named Executive Officers was approved, the level of support was lower than it has been in the past; it was not a level that is acceptable to Antero.

Over the past year, Antero has contacted our top 25 shareholders representing approximately 80% of our outstanding shares. Approximately one-third of these shareholders agreed to meet with us and provide feedback on our executive compensation program. Robert J. Clark, the Compensation Committee Chairman, Alvyn A. Schopp, our Chief Administrative Officer and Senior Regional Vice President, Michael N. Kennedy, Senior Vice President of Finance, and John Giannaula, Vice President of Human Resources and Administration, participated in these conversations, which covered shareholder concerns and explored specific changes we could make to our executive compensation program to address those concerns. Mr. Clark participated in eight out of nine of these meetings.

At the 2018 Annual Meeting of Shareholders, Antero will again hold an annual advisory vote to approve executive compensation. The Compensation Committee will continue to engage with shareholders throughout the year so that we may understand their perspectives and address their feedback regarding our practices going forward.

|

- 2018 Proxy Statement 25 |

The chart below summarizes the key points we heard from our shareholders, what action the Compensation Committee has taken to address their feedback, and when the changes will become effective.

| What we heard | How we responded | When effective | Where to find more information | |||

| The annual incentive plan is difficult to understand, and it is unclear how final payouts are determined | Simplified the annual incentive plan by reducing the number of performance metrics and selecting metrics that are more objective | 2018 Annual Incentive Plan | Changes to 2018 Annual Incentive Plan | |||

| Improved disclosures to make the mechanics easier to understand | CD&A in this Proxy Statement | Annual Cash Incentive Awards | ||||

| Annual incentive plan should utilize fewer key performance measures, and focus on those that are more closely tied to current corporate strategy | Reduced the number of performance measures to four—all key metrics that are aligned with shareholder expectations: Debt-Adjusted Net Production Growth per Share, Net Debt/EBITDAX, Free Cash Flow, and safety and environmental | 2018 Annual Incentive Plan | Changes to 2018 Annual Incentive Plan | |||

| An absolute performance measure and certain key financial measures should be incorporated into the executive compensation program | Added absolute total shareholder return (“TSR”) and return on capital employed as performance measures for the long-term equity performance share unit awards | Performance share unit awards for 2018–2020 | 2018 AR LTIP Grants | |||

| Reevaluate the relative target compensation level for long-term equity incentive awards | Lowered our target compensation level for long-term equity grants to the 50th percentile relative to our peers, consistent with all other elements of compensation | Long-term equity grants in 2018 | 2018 AR LTIP Grants | |||

| Reevaluate the portion of our long-term equity incentive program that consists of performance-based awards | Increased the portion of our long-term incentive program that is performance-based to 100% for our Named Executive Officers | Long-term equity grants in 2018 | 2018 AR LTIP Grants |

We enthusiastically embrace these changes. We believe they will strengthen the link between our executive compensation program and shareholder value creation, and directly support the achievement of Antero’s goals.

The following discussion provides information about our compensation decisions and policies with regard to our Named Executive Officers for the 2017 fiscal year, and provides context for the disclosure included in the executive compensation tables below.

2017 Company Performance Highlights

In 2017, Antero:

| • | Achieved 16% debt-adjusted net production growth per share; |

| • | Reduced our finding and development costs by 13% from 2016 and 48% from 2015; |

| • | Monetized over $1 billion of non-exploration and production assets to pay off all outstanding borrowings on the credit facility in the third quarter of 2017; and |

| • | Recorded a 0.03 lost time incident rate (“LTIR”) and 0.57 total recordable incident rate (“TRIR”), representing reductions of 80% and 18%, respectively, from the prior year and the lowest annual LTIR and TRIR on record for Antero. |

|

- 2018 Proxy Statement 26 |

Compensation Philosophy and Objectives of Our Compensation Program

Since our inception, our compensation philosophy has been predominantly focused on recruiting individuals who are motivated to help Antero achieve superior performance and growth. Antero was founded by entrepreneurs whose strategy was to employ high-impact executives who are extremely effective at sparking superior performance with low overhead. These highly qualified and experienced individuals have contributed to Antero’s continued success, driving an 18% compound annual growth rate in debt-adjusted net production per share and a 23% compound annual growth rate in oil and gas net proved reserves since our 2013 IPO.

Historically, to achieve our objectives, we sought to implement a compensation program that reflected the unique strategy and entrepreneurial culture of our organization. Specifically, we sought to reward our Named Executive Officers by emphasizing long-term equity-based incentive compensation, which allowed our senior leaders to build significant ownership in Antero. We believe this approach served to motivate our Named Executive Officers and to align their interests with those of Antero and our shareholders. Our Named Executive Officers currently hold approximately 9% of our outstanding shares, which ensures they identify with the best interests of our shareholders.

As the company continues to mature, we are transitioning from an entrepreneurial-based management incentive structure to a more traditional compensation program. This transition calls for us to consider certain modifications to our compensation philosophy and attendant adjustments in our compensation program. More specifically, our goal is to shift the emphasis of our incentive-based compensation program from operational performance and absolute growth metrics to performance metrics focused on returns and value creation per share that will reward more disciplined capital investment, efficient operations, and free cash flow generation. In addition, for calendar year 2018, as discussed below, we have adopted a simplified annual incentive program that focuses on four key performance metrics. Further, our compensation program will target the market median for all elements of our Named Executive Officers’ compensation. We believe these changes to our compensation philosophy and practices will promote a stronger alignment between Named Executive Officer pay and company performance, and deliver greater value to our shareholders as Antero continues to grow and mature.

The following table highlights the compensation best practices we follow.

| What We Do | |

|

Use a representative and relevant peer group |

|

Apply robust minimum stock ownership guidelines |

|

Link annual incentive compensation to the achievement of objective pre-established performance goals tied to operational and strategic priorities |

|

Evaluate the risk of our compensation programs |

|

Use and review compensation tally sheets |

|

Provided more than 50% of 2017 long-term incentive awards in the form of performance-based equity (for 2018, 100% of long-term incentive awards for Named Executive Officers will be performance-based equity) |

|

Use an independent compensation consultant |

| What We Don’t Do | |

|

No tax gross-ups for executive officers |

|

No “single-trigger” change-in-control cash payments |

|

No excessive perquisites |

|

No severance arrangements for Named Executive Officers |

|

No guaranteed bonuses for Named Executive Officers |

|

No management contracts |

|

No re-pricing, backdating or underwater cash buy-outs of options or stock appreciation rights |

|

No hedging or pledging of Antero stock |

|

No separate benefit plans for Named Executive Officers |

|

No granting of stock options with an exercise price less than the fair market value of Antero’s common stock on the date of grant |

|

- 2018 Proxy Statement 27 |

Implementing Our Compensation Program Objectives

Role of the Compensation Committee

The Compensation Committee oversees all matters of our executive compensation program and has the final decision-making authority on all executive compensation matters. Each year, the Compensation Committee reviews, modifies (if necessary), and approves our peer group, corporate goals and objectives relevant to the compensation of the Chief Executive Officer (“CEO”) and other executive officers, and the executive compensation program. In addition, the Compensation Committee is responsible for reviewing the performance of the CEO and the President, Chief Financial Officer and Secretary (“President/CFO”) within the framework of our executive compensation goals and objectives. Based on this evaluation, the Compensation Committee sets the compensation of the CEO and the President/CFO.

The CEO and the President/CFO typically provide recommendations to the Compensation Committee regarding the compensation levels for the other executive officers and for our executive compensation program as a whole. In making their recommendations, the CEO and the President/CFO consider each executive officer’s performance during the year, Antero’s performance during the year, and comparable company compensation levels and independent oil and gas company compensation surveys. The Compensation Committee considers these recommendations when reviewing the performance of, and setting compensation for, the other executive officers.

Actual compensation decisions for individual officers are the result of a subjective analysis of a number of factors, including the individual officer’s role within our organization, performance, experience, skills or tenure with us, changes to the individual’s position, and relevant trends in compensation practices. The Compensation Committee also considers a Named Executive Officer’s current and prior compensation when setting future compensation. Specifically, current compensation is considered a base, and the Compensation Committee determines whether adjustments to that base are necessary to retain the executive in light of competition and to provide continuing performance incentives. Thus, the Compensation Committee’s decisions regarding compensation are the result of the exercise of judgment based on all reasonably available information and, to that extent, are discretionary.

Role of External Advisors

The Compensation Committee has the authority to retain an independent executive compensation consultant. For 2017, the Compensation Committee retained Frederic W. Cook & Co., Inc. (“F.W. Cook”). In compliance with the SEC and NYSE disclosure requirements, the Compensation Committee reviewed the independence of F.W. Cook under six independence factors. After its review, the Compensation Committee determined that F.W. Cook was independent.

In 2017, F.W. Cook:

| • | Collected and reviewed all relevant company information, including our historical compensation data and our organizational structure; |

| • | With input from management, established a peer group of companies to use for executive compensation comparisons; |

| • | Assessed our compensation program’s position relative to market for our Named Executive Officers and stated compensation philosophy; |

| • | Prepared a report of its analysis, findings and recommendations for our executive compensation program; and |

| • | Completed other ad hoc assignments, such as helping with the design of incentive arrangements and special awards. |

F.W. Cook’s reports were provided to the Compensation Committee in 2017. In addition, Messrs. Rady and Warren used F.W. Cook’s report dealing with competitive compensation levels when making their recommendations to the Compensation Committee.

|

- 2018 Proxy Statement 28 |

Competitive Benchmarking

When assessing the soundness of our compensation programs, the Compensation Committee compares the pay practices for our Named Executive Officers against the pay practices of other companies. This process recognizes our philosophy that our compensation practices should be competitive, though marketplace information is only one of the many factors we consider.

Messrs. Rady and Warren used market compensation data provided by F.W. Cook to assess the total compensation levels of our top six executives relative to market, and to make recommendations to the Compensation Committee. Market data is developed by comparing each executive officer’s compensation with that of officers in similar positions with companies in our Peer Group (described below) and with those in the E&P industry in general. To the extent possible, we consider the specific responsibilities assumed by our executives and those assumed by executives at other organizations (based on peer SEC filings) to determine whether the positions are comparable. We give greater weight to Peer Group data if a position appears comparable to the position of one of our Named Executive Officers. Otherwise, we supplement Peer Group data with industry data from the 2017 Oil and Gas E&P Industry Compensation Survey prepared by Effective Compensation, Incorporated.

Peer Group

In 2017, F.W. Cook identified a peer group of onshore publicly traded oil and gas companies that are reasonably similar to us in terms of size and operations. We refer to the following 16 companies as the “Peer Group”:

| • Cabot Oil & Gas Corporation | • EQT Corporation | • Range Resources Corporation |

| • Cimarex Energy Co. | • Newfield Exploration Company | • SM Energy Company |

| • Concho Resources Inc. | • Noble Energy, Inc. | • Southwestern Energy Company |

| • Continental Resources Corporation | • Pioneer Natural Resources Company | • Whiting Petroleum Corporation |

| • Devon Energy Corporation | • QEP Resources, Inc. | • WPX Energy, Inc. |

| • Energen Corporation |

Positioning versus market

Due to the broad responsibilities of our Named Executive Officers, applying survey data to them can be difficult. However, as discussed above, our compensation objective is to be competitive with our peer companies. Therefore, in assessing the competitive positioning of our Named Executive Officers’ compensation relative to the market, the Compensation Committee also considered our productivity relative to our peers.

We determined that it was appropriate to target the median of the Peer Group for base salaries and annual cash incentive awards and, for 2017, the 75th percentile of the Peer Group for long-term equity-based incentive awards. As Antero continues to mature, we regularly assess how our incentive program is structured to retain key management employees and align their interests with those of our shareholders. As a result of our shareholder outreach program, beginning in 2018, the Compensation Committee determined that long-term equity-based incentives should target the 50th percentile of the Peer Group. We believe this better reflects our compensation philosophy and provides the necessary incentive at this stage in Antero’s progression.

For the 2017 program, the Compensation Committee considered, among other things, publicly available data of direct peer companies matching our operational profile that measures productivity using various individual employee metrics. These metrics included EBITDAX per employee, drilling and completion capital per employee, production per employee, proved reserves per employee, and market value per employee. Our performance with respect to these metrics continues to excel (in each case we ranked first or second among the direct peer group), and we believe these metrics provided a reasonable

|

- 2018 Proxy Statement 29 |

basis for our 2017 compensation decisions. However, we recognize that we must continually ensure that our incentive program is aligned with the interests of our shareholders. Therefore, the Compensation Committee determined that, beginning in 2018, the relative performance of our Named Executive Officers should more closely match the performance of the Peer Group and that our compensation amounts should be adjusted to match the median of the Peer Group.

Elements of Direct Compensation

Our Named Executive Officers’ compensation includes the key components described below.

| Pay component | Form of pay | How amount is determined | Objective | |||